When it comes to safeguarding digital assets, choosing the right crypto wallet is a crucial decision. Crypto wallets fall into two main categories: cold wallets (hardware devices) and software wallets (applications installed on your computer or smartphone).

Each type offers distinct benefits and drawbacks depending on your investment style, security priorities, and convenience needs. This article explores the differences between cold wallets and software wallets to help you make an informed choice.

What Are Cold Wallets?

Cold wallets, also known as hardware wallets, are physical devices that store private keys offline. By keeping keys disconnected from the internet, they provide one of the highest levels of security against hacking attempts.

Advantages of Cold Wallets

- Enhanced Security: Private keys remain offline, making cold wallets highly resistant to malware and phishing attacks.

- Best for Long-Term Storage: Ideal for investors who plan to hold large amounts of crypto for extended periods.

- Physical Authentication: Access typically requires both the device and a PIN or password, adding extra layers of protection.

Disadvantages of Cold Wallets

- Cost: Most reputable cold wallets cost between $50 and $200.

- Limited Asset Support: Devices like Ledger and Trezor support thousands of assets but fewer than leading software wallets.

- Convenience: Transactions require connecting the hardware wallet to a computer or phone, making them less practical for frequent trading.

What Are Software Wallets?

Software wallets, often called hot wallets, are applications installed on mobile devices, browsers, or desktops. They store private keys locally on the device but remain connected to the internet for quick transactions.

Advantages of Software Wallets

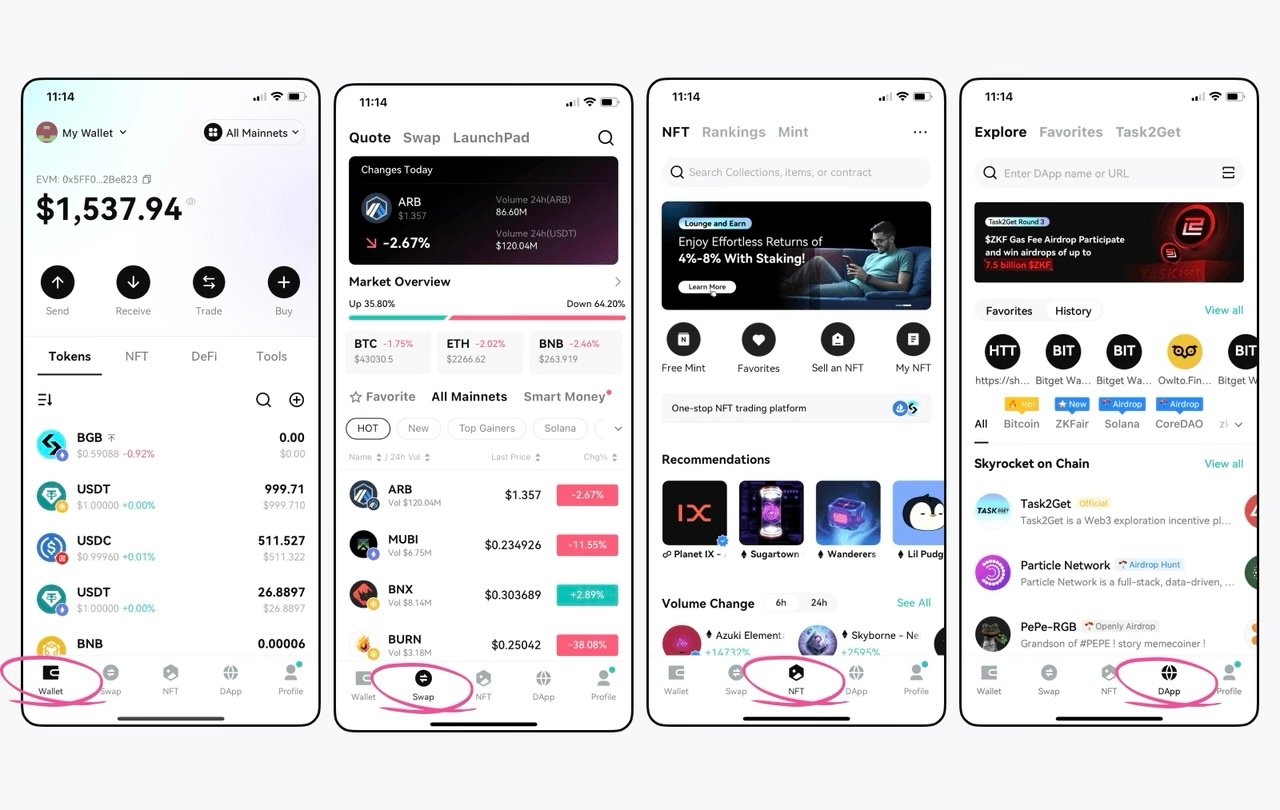

- Accessibility: Easy to use, fast, and highly convenient for daily transactions.

- Wide Asset Support: Wallets such as Bitget Wallet support millions of tokens across 130+ blockchains.

- Free to Use: Most software wallets are free to download and install.

- Integration with Web3: Enable seamless access to decentralized applications, staking, and DeFi services.

Disadvantages of Software Wallets

- Security Risks: Being online makes them more vulnerable to hacking, phishing, and malware.

- Device Dependency: If your device is compromised, lost, or stolen, your wallet could be at risk.

- Recovery Reliance: Losing your recovery phrase can result in permanent loss of funds.

For those looking to manage specific networks, using a TRC20 wallet can be an effective choice for interacting with TRON-based assets.

Key Differences Between Cold and Software Wallets

When choosing how to store your digital assets, it’s important to understand the key differences between cold wallets and software wallets:

| Category | Cold Wallets | Software Wallets |

| Security | Highest level of protection since keys remain offline. | More exposed but can be secured with 2FA and biometric locks. |

| Accessibility | Require physical access and device connection, making them slower for transactions. | Allow instant transactions, ideal for active traders. |

| Cost | One-time hardware purchase ranging from $50 to $200. | Free to install and use. |

| Asset Support | Support thousands of tokens, but more limited compared to software wallets. | Support millions of tokens across a broader set of blockchains. |

| Best Fit by User Type | Best for long-term holders prioritizing maximum security. | Best for active traders, beginners, and those seeking convenience. |

Both wallet types serve different needs, so choosing the right one comes down to your trading style and security preferences.

Security Risks and Best Practices

While wallets are designed to secure your digital assets, user practices play a major role in overall safety.

Common Risks

- Phishing Attacks: Fraudulent websites or apps trick users into entering their seed phrases.

- Malware: Keyloggers or viruses on compromised devices can expose wallet details.

- Loss of Recovery Phrases: Without a backup, users cannot regain access to funds.

- Physical Theft: Both cold and software wallets can be compromised if attackers gain physical access.

Best Practices

- Backup Recovery Phrases: Store them offline in multiple safe locations.

- Use Two-Factor Authentication: Adds an extra layer of protection for software wallets.

- Verify Download Sources: Only install wallets from official websites or trusted app stores.

- Regular Updates: Keep both software wallets and connected devices up to date to patch vulnerabilities.

- Diversify Storage: Consider splitting holdings across multiple wallets to reduce risk.

Also Read: 5 Benefits of a Virtual Corporate Card for Managing Expenses

Use Cases: Which Wallet Should You Choose?

For Beginners and Frequent Traders

A software wallet provides accessibility, a user-friendly design, and support for a wide range of assets. Apps like Bitget Wallet make it simple to trade trending memecoins, store stablecoins, and explore DeFi with minimal barriers.

For Long-Term Investors

Cold wallets are the preferred option for those securing large crypto holdings for the long run. The offline nature significantly reduces exposure to cyber threats.

The Hybrid Approach

Many users combine both options. For example, a software wallet can manage smaller, frequently traded funds, while a cold wallet secures larger, long-term holdings.

Cold vs. Software Wallets: Quick Comparison Table

| Feature | Cold Wallets | Software Wallets |

| Security | Offline, highly secure | Online, higher risk |

| Accessibility | Less convenient | Instant access |

| Cost | $50–$200 | Free |

| Asset Support | Thousands | Millions |

| Best For | Long-term storage | Daily use, trading, DeFi |

Conclusion: Finding the Right Wallet for Your Needs

The choice between cold wallets and software wallets depends on your goals and risk tolerance. Cold wallets offer unmatched security for long-term storage, while software wallets provide convenience and broad functionality for daily use. Many investors find the best approach is to use both together to balance safety and accessibility.

Ultimately, the right wallet depends on how you plan to manage your assets. For users seeking an all-in-one solution, Bitget Wallet combines secure stablecoin storage, hot memecoin trading, and seamless cross-chain access, making it one of the best crypto wallet choices available today.