The startup market continues to be a competitive minefield in 2024. From a spike in e-commerce retailers to inflation’s grip hold on struggling entrepreneurs, turning a profit in 2024 has not been easy.

Studies show that 20% of startups don’t even make it past the first-year mark. In a post-pandemic playing field, startup success is both uncertain and unguaranteed. With over half of all online businesses still recovering from Covid-19’s cash flow consequences, there is still a rocky road ahead for many.

The question is, just how prepared should business leaders be for a potential disaster? With cyber breaches looming, prices increasing and competition growing should small business owners be splashing the cash on their strategy or saving their pennies in a backup fund?

Read on as we explore the risks of the startup grind post-pandemic and discuss three of the main reasons entrepreneurs should save their money in 2024.

The Risks of the Startup Grind in 2024

There are several risks associated with starting a business in 2024. From competitive niche markets to perfecting a social media strategy that will rival industry giants, entrepreneurs need to be prepared to fall and pick themselves back up again.

As you can see above, some of the main reasons startups fail are attributed to a stagnant product market and of course cash flow problems.

Just under a third of startups shut down due to a lack of funding. As VC and Angel Investors turn towards tech in a digitally dominated market, several small business niches find themselves unable to secure dilutive forms of funding, whilst still battling against industry giants.

In an online landscape, only 40% of startups have been profitable since the onset of the Covid-19 pandemic. As inflation continues to rise, we expect that number will continue to fall in 2024.

Should Entrepreneurs Have Backup Funding in Place?

The question is, should online entrepreneurs be tackling competition with spending-induced strategies or be tucking away the pennies to pick themselves up when they fall? To see success, startup leaders need to create a balance.

While tech innovation and increased marketing spending will improve brand awareness, customer engagement, and return on investment, let’s have a closer look at the three key factors that should encourage business leaders to save as well as spend in 2024.

Increased Competition

Increased competition continues to stand out as one of the most significant issues faced by online entrepreneurs. On the back of an e-commerce boom, with retailer numbers rising by 35% since 2020, small business leaders are working twice as hard to secure funding, labour, and engagement alongside their rivals.

It’s no secret that increased competition means increased spending to secure a winning strategy. Alongside retailer rivals, entrepreneurs are also firehosing funds into their personalisation strategies.

As digital consumers continue to evolve, so do their demands. To see increased levels of engagement and customer retention, startups of today need to offer their demographic a personalised, tailored experience that speaks directly to their values.

One competitive market we didn’t expect to see in 2024 however, was the labour market. With only half of corporate workers looking to career swap post-pandemic, many small business leaders are dealing with a skill shortage amongst other competition.

“Obtaining talent is one of the biggest risks facing companies in 2024,” comments Kim Pope, COO of talent acquisition firm, WilsonHCG. “The talent market has long been strained. Many organizations were grappling with skills shortages pre-pandemic. But now, severe skills shortages aren’t reserved for certain industries almost all sectors are experiencing them. And changing candidate and employee expectations, rising inflation, and a record number of job openings are only exacerbating the situation.”

Cyber Attacks

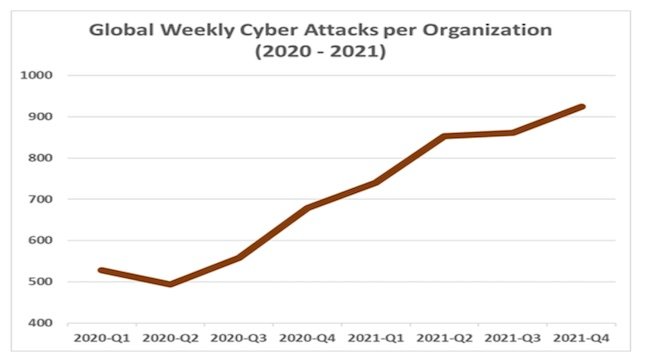

Cyber attacks have risen by 50% year on year since the onset of the pandemic. In response to COVID-19’s digital shift, more online entrepreneurs than ever before have experienced cyber-based breaches, costing smaller startups an average of $25,000 per breach.

With a cash flow dip that is financially detrimental, many cyber breach victims fall into administration during the financial recovery. Therefore entrepreneurs will need a backup funding pot if they are going to pull themselves out.

“The biggest risk companies will face in the coming year is the risk of having their data breached. Organizations for years have said, “It’s not if you’ll be breached, it’s when” claims Kevin Coppins, CEO of Spirion.

“The shift we are starting to see accelerate is organizations experiencing multiple incidents in a single year, and the types of incidents are expanding. This is a direct result of the ever-expanding data universe, accelerated by the global pandemic and the evolving regulations surrounding sensitive data.”

The Cost of Inflation

According to Quickbooks, over 97% of all small business owners are concerned about the financial repercussions of inflation.

After the UK saw inflation rise past the 7% mark in March 2022, reading at the highest levels in over a decade, it’s no surprise that two-thirds of e-commerce retailers are planning to raise prices over the next six months.

“The prices have gone up and such an increase will impact most companies, no matter what industry they’re in. The standard will change, costs will increase, and the competition will become fierce,” claims Quickbooks representative Simon Worsfold.

If entrepreneurs want to make it out of 2024 unscathed, it’s time to step back from splurging and secure a backup fund that is guaranteed to pull a small business out of a sticky situation.