Today’s insurance market is highly influenced and driven by digital disruption, rising competition, the emergence of new entrants, new regulations, and fast-growing and changing customer demand.

The recent Global Insurance Business Process Outsourcing (BPO) Market report by Verified Market Research analyzes some of the key segments, restraints, trends, and many other factors affecting the market at a substantial scale.

According to the report, the insurance BPO market, valued at $5.8 billion in 2020, is expected to grow at a CAGR of 4.20% between 2021 and 2028, reaching $10.2 billion by 2028.

Insurance Business Process Outsourcing Services – Market Outlook 2030

Insurance Business Process Outsourcing is a strategic option that insurers invest in; in fact, it is more of a process to manage most back-office operations such as bookkeeping, accounting, policy administration, claims management, etc. Insurance companies and agencies see insurance BPO as an excellent approach to accessing difficult-to-find talented and skilled insurance specialists.

According to the Global Opportunity Analysis and Industry Forecast, 2021–2030, the growing adoption of digital and especially cloud-based insurance solutions, the increasing need to manage operations cost-effectively, and the utter need to optimize insurance processes are some factors driving the insurance business process outsourcing market during the forecast period.

You May Read: What is a Business Process Outsourcing Company?

Current State of the Insurance Sector

Insurers might be lagging when it comes to gaining operational efficiency due to a shortage of process standards and the absence of a strategic approach to operational excellence.

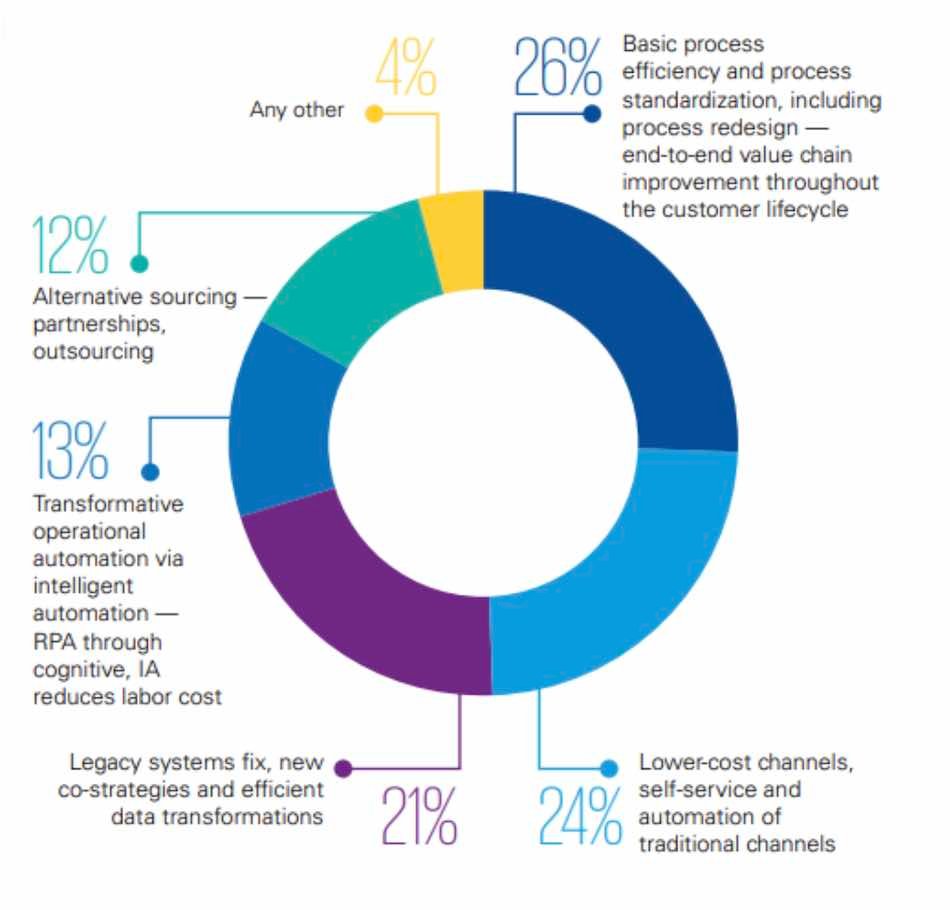

KPMG’s Operational Excellence Report states that currently, most carriers are putting their focus on process redesigning, implementing cost-effective sales and customer servicing channels, and initiating the improvement or replacement of legacy systems.

Insurance businesses that could not focus on enhancing operational efficiency might fail to build or further improve their competitiveness based on pricing and profitability. The end result can be even worse as they might not be able to meet the expectations of agents, customers, and brokers.

You May Read: Growth in Commercial Fleet Rental Market

Challenges in Optimizing Insurance Operations

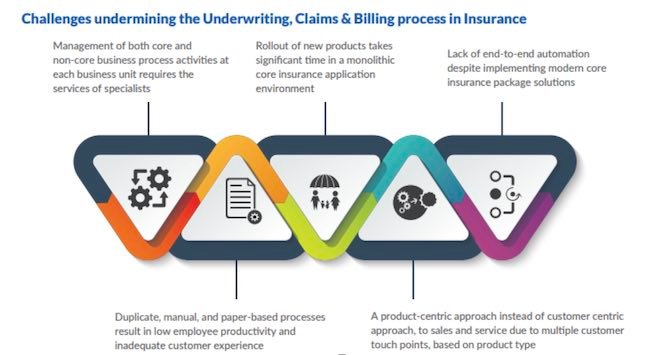

Although businesses in the insurance sector have already been dealing with multiple challenges over the past couple of decades, COVID-19 has just brought more or intensified the existing ones. Amid the global pandemic, health crisis, and economic uncertainty, the following are some of the top challenges insurers face today.

- High employee turnover rates

- Increasing cost of recruitment also difficulty in finding the right talent

- Difficult to boost productivity

- Challenging to improve customer experience

- Difficult to generate value for shareholders

Today’s insurers’ primary goal is to deliver customized CX across all touchpoints and channels in a consistent manner. Insurers see technology as a considerable aid in obtaining operational excellence; however, they realize it can only be beneficial if backed up by a solid operating model and sufficient technology budgets.

Can Operational Excellence Transform the Insurance Industry?

At the core of any insurance business, operational excellence is an integral element of embracing various methods, techniques, and tools in order to focus on improving performance and obtaining long-term business sustainability. With frequently changing customer expectations and capabilities insurers are gaining via technology adoption, one great way operational excellence is affecting insurance is operating speed.

Operational excellence is helping insurers streamline functioning, transform legacy systems, speeding up the time-to-market for insurance products. So let’s get further and learn about three ways operational excellence can transform insurance.

The Opportunity to Boost Profitability & Scale

Insurance companies face challenges due to fast-growing new entrants, and these challenges are restricting their ability to increase profit margins and scale. Consequently, the insurance sector can experience uncertainty, and some big players might be impacted. Moreover, insuretech startups and the increasing popularity of micro-insurance policies are reshaping the industry.

However, many insurers are gaining efficiency and profitability, unlocking scaling opportunities, and obtaining operational excellence via optimization-focused outsourcing models.

Automation & Process Optimization

The rapid emergence of automation-powered tech solutions in insurance reflects the growing need for digital transformation. However, this ongoing adoption also increases customer expectations for a higher level of quality in products and services. Across insurance lines, such expectations are encouraging insurers to address mistakes and complaints and increase operational efficiency.

On that note, obtaining operational excellence and adopting process automation and other solutions seem equally important.

Advanced Analytics, AI, & ML

Insurers collect and store a substantial amount of data. However, beyond data entry and management, insurers need to gain reliable, intelligent insights that can further help them make sound decisions.

Apart from that, excellent use of machine learning and artificial intelligence is breaking through in insurance very fast. They are augmenting several other insurance process management solutions to drive more value. Besides, most of these tech solutions are helping insurers get in a better position to leverage the data available in abundance.

You May Read: How to Improve Operational Efficiency?

How Insurance BPO Helps to Achieve Operational Excellence

As discussed, insurance companies and agencies embrace technology to maximize their capabilities and efficiency; it is just not enough. There is a need to come one step ahead of low-value, tedious, time-consuming, high-volume manual operations. However, it is not about replacing your staff with automated processes but bringing in solutions to support their effort for the company.

Here comes insurance outsourcing into the picture; insurance BPO firms are helping insurers drive operational excellence, all while enabling them to have more time for core focus areas and bring down high-rising operating costs. Here’s how!

The Virtual Workplace

With broad experience in process designing and management, insurance BPO helps insurers (via a virtual operating setup) utilize top, industry-standard software and tools required to outperform competitors.

Migration from Legacy Systems

With insurance BPO, you can take support in upgrading outdated systems or setting up insurance software from scratch. This helps modernize and optimize processes, leading to operational excellence.

The Cloud Journey

Data centers are a big thing in insurance today, especially as it is fast becoming digital with each passing day. Here, managing hybrid clouds handling and leveraging data on the cloud are becoming easier with insurance BPO.

Underwriting & Product Development

The core insurance business is ‘selling policies’ that require excellent underwriting capabilities that foster fast and accurate creation of policies. Insurance BPO firms are offering high-quality underwriting services, transforming this key aspect.

Customer Service & Experience

Insurance outsourcing companies offer customer support services, often unmatched by any competitive insurer, to help their insurance clients handle customers and customer interactions effectively.

Business Growth & Expansion

As an insurance company, if you get skilled and experienced insurance specialists to work for you at a fraction of the costs you would pay for recruitment and training, you save a good amount of money that can be better utilized somewhere you can get higher returns. In addition, BPO firms delivering excellence help improve the overall functionality, capacity, productivity, and profitability of the insurance firm, adding value to their bottom line.

How Operational Excellence Enables Insurance Business Transformation

By focusing on the areas discussed above, the insurance business can obtain operational excellence. And with insurance BPO, they not just achieve excellence in operations but also sustain it for long. However, it is not something that only a third-party partner can provide; it already exists in everything a company does; all it needs is to bring it out.

Yes, operational excellence can optimize insurance business processes, helping them become agile, improve data security, increase capacity, and streamline functionality – all required to run and scale a successful and reputed insurance business.