A mutual fund is considered a professionally managed, controlled, and supervised investment scheme that is generally governed and run by any asset management organization…

For bringing in closer a group of people for investing money in stocks, bonds, and other security platforms.

It is also collected from many investors for investing in many other securities such as the money market and respective assets.

Mutual Funds for Beginners

In this short-phased article, we prioritize and indicate the starter funds which are appropriate for the beginners. All the selections are based on certain pre-assumptions, that you are eligible to carry forward a minimum amount of risk along with the bearing capability of three years long timescape.

The other investors might concentrate on bank fixed deposits and government saving products PPFs and NSCs.

You May Read: What is Fund of Funds?

Franklin India Equity Fund

The significant features are respectively;

- Category – Equity Multicap

- Fund Size or AUM – 11,400 Crores of rupees.

- Date of inception – January 1, 2013.

This kind of fund is most suitable for the beginner kind of investors who are up and ready for an above-average risk in the hope for a better gain and relatively higher return. It is considered as a multi-cap fund that enables to invest in large, mid and small-cap organizations. Mid and small-cap organizations feature higher risk factors and relatively higher return; The important points are hereby mentioned below;

- The regular option of the fund was promoted in the year 1994 and since then it has been in service for the last 25 years.

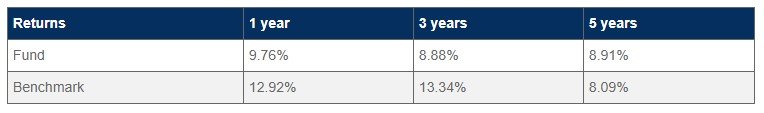

- The fund has been a dawdler in its short term perspective against the benchmark but in the long run, the growth detailed history has remained steady and to the point.

- The management of the fund by Anand Radhakrishnan and R. Janakiraman from the year 2013 has brought forth a lot of knowledge and experience onboard.

- The fund is recently inclined towards large caps with a sum of 62.08% of its assets within these organizations and reduces the risk of investors. 20% of the assets have been placed in the mid and small-cap space opening it up to several growth opportunities.

- The asset allocation through sectors has also been balanced and efficient. The S&P BSE 500 is little inclined to favor of the financial sector with an asset allocation of 20.71%. The fund has allocated 23.5% of its portfolio in the financial sectors of organizations.

A short presentation can make the scenario transparent;

ICICI Prudential Equity and Debt Fund –

The important features can be mentioned hereby as;

- Category – Aggressive Hybrid Fund.

- Fund Size or AUM – 23,950 Crores of rupees.

- Date of Inception – 3rd November 1999

This fund generally puts all its effort into making a combination of the growth potential of equity and safety caution of debt. The important features are respectively;

- Due to its aggressive hybrid fund characteristics, it requires an investment of 65% of its corpus inequities.

- For various tax purposes, the assurance of it is to be treated as an equity fund is extremely necessary.

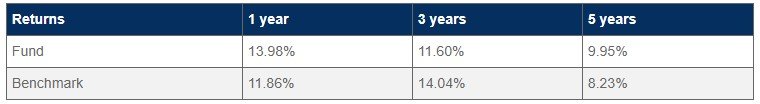

- The fund was launched just one month after turning into the new millennium, however, the return over the last 3,5 and 10 years are respectively; 10.79%, 10.42%, and 9.88%.

- The market correction in the year 2018 declined the fund growth massively like many other mutual funds which provided an opportunity for investors to enter any market at a low and promising evaluation.

- The fund is getting managed superbly under the supervision of Atul Patel, Manish Banthia, and Sankaran Naren.

- The fund has been distributed in 74.24% assets in equity, 24.68% assets in debt, and 1.08% in cash.

This can be portrayed through a small detail which is exhibited below;

SBI Bluechip Fund

The important notations can be mentioned hereafter;

- Category: Equity Large Cap

- Fund Size or AUM: 23,585 crores of rupees

- Date of Inception: 14th February 2006.

This fund is governed and run by one of India’s most trusted fund houses and can be considered a beautiful started fund for investors who are investing money for the first time. As a large-cap fund, it holds 80% of its assets in the topmost 100 organizations by market cap. Higher allocation to the large-cap space makes a reduction of the risk the first-time investors face during the market correction.

The important features can be hereafter mentioned as;

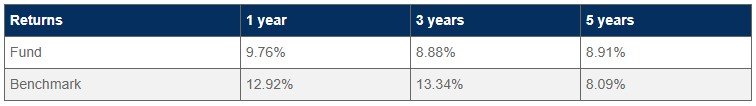

- The fund has visualized and experienced a slowdown through the last three years than its benchmark but long-term returns are the witnesses which prove an over-performance by the fund manager.

- The fund’s CAGR is 9.95% in the last five years.

- Due to the fund manager’s extensive and very appealing experience and charm the investors have benefitted from 2010, who has been none other than Sohini Adnani.

- 88% of the fund’s assets have been invested in large caps. The largest holdings by Sohini Adnani reflect HDFC, ITC, ICICI, and all the other high-quality blue chips in India.

The portrait can be hereby presented as;

Aditya Birla Sun Life Balanced Advantage Fund –

The crucial features can be listed as;

- Category: Dynamic Asset Allocation

- Fund Size or AUM: 2741 Crores of Rupees

- Date of inception: 25th April 2000

This fund falls in the category of the Hybrid Fund. The fund is capable of utilizing various derivatives for reducing the exposure to equity below 65%. The actual equity exposure remains far below 65% but the fund is taxed as an equity fund.

- The fund is capable of delivering 5-year returns of 8.91% and 3-year returns of 8.88%.

- The fund has performed well enough and the last year’s returns have been recorded as 9.76%.

- The investors benefitted from the failing markets for the debt exposure of 21.47% and cash returns of 13.03%.

The portrayal is below;

Best Tips to Invest Your Money

The best tips can be considered as respectively;

- Reviewing the necessities and goals.

- The time of investment.

- The proper investment plan.

Conclusion

The above-mentioned can be undoubtedly considered the best mutual funds for beginners to invest in.