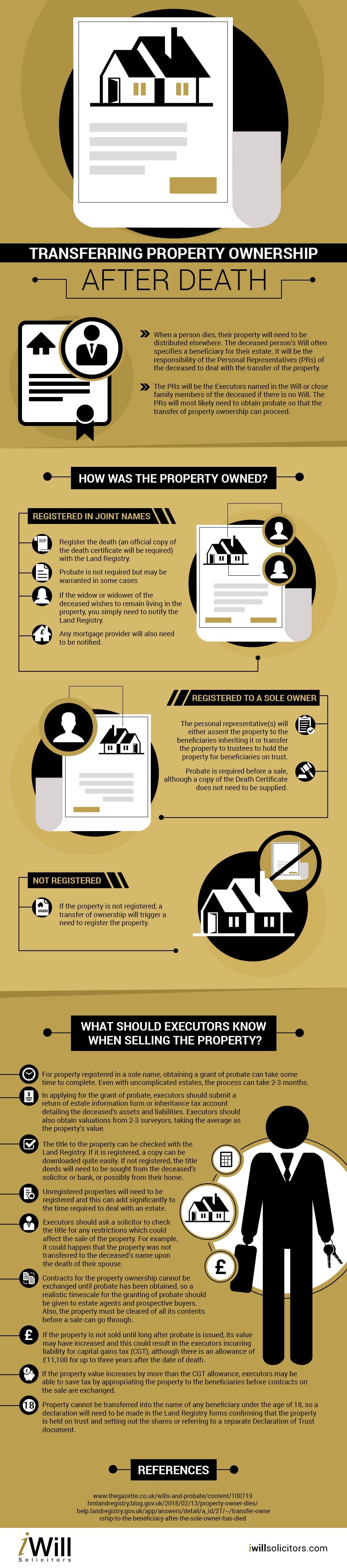

Read the infographic guide below to understand more about how to transfer ownership of a property following the death of the owner. When a person dies, any property they own will need to be transferred to a beneficiary.

The personal representatives (PRs) of the deceased will act as Executors of the Will, as such, they will be responsible for transferring ownership of the property.

Understanding Ownership of Property

It’s also important to bear in mind that specific elements of the process may change depending on whether the property was registered solely or jointly. There are three different ways the ownership of a property can be registered.

- Sole Ownership

- Joint ownership

- Not registered

You May Like to Read: ATO Audits

Selling A Property Following the Death of the Owner

If the beneficiaries don’t want to transfer the property into their own names, the executors will have to sell it. The sales process for a Probate property tends to be a little more complicated than typical property transactions, so there are a number of things you will need to keep in mind.

Read this Infographic to Learn More

If you would like to find out more about how to transfer ownership of a deceased person’s property, then you may be interested in this helpful infographic explainer. This guide lays out some of the most crucial points regarding the transfer of property after death.

It takes you through the three main types of property ownership and also features some useful information for executors who are selling off property. Read the infographic below to learn more