A personal loan is a loan that you take when you are in great need of finances. But for getting a loan you must meet the eligibility criteria of a personal loan.

If you will not be able to meet the eligibility criteria, your loan application will be rejected right away.

So, it would be better to know whether you are eligible for getting a loan or not instead of rejecting your loan application and making a bad entry on your credit report.

Both the banks and lenders have their own eligibility criteria for a personal loan, there is not much difference.

The eligibility criteria for a personal loan are different for salaried people, self-employed people, and pensioners. So the parameters for judging them are also different.

The category of salaried people includes the persons who are salaried doctors, employees of private limited companies, and government sector employees which includes employees from the public sector undertakings including central, local, and state bodies, The amount for which you will be eligible to get a loan will need to be checked out with banks as it is dependent on many factors such as your income industry you are working, and many more.

If you are a salaried person and want to apply for a personal loan then the parameters that you need to match up for a loan will be as follows:

Age

For most of the banks, the minimum age limit is 21 years and the maximum age limit is 60 years. There are some banks that have criteria for the minimum age of 25 years and the maximum age of 58 years.

Salary: If you are working in any metro cities such as Bangalore, Delhi, Mumbai, Chennai, Pune, Hyderabad, and Kolkata, then your minimum net salary should be Rs 20000 per month. Besides these cities, you will need a salary of Rs 15000 net per month.

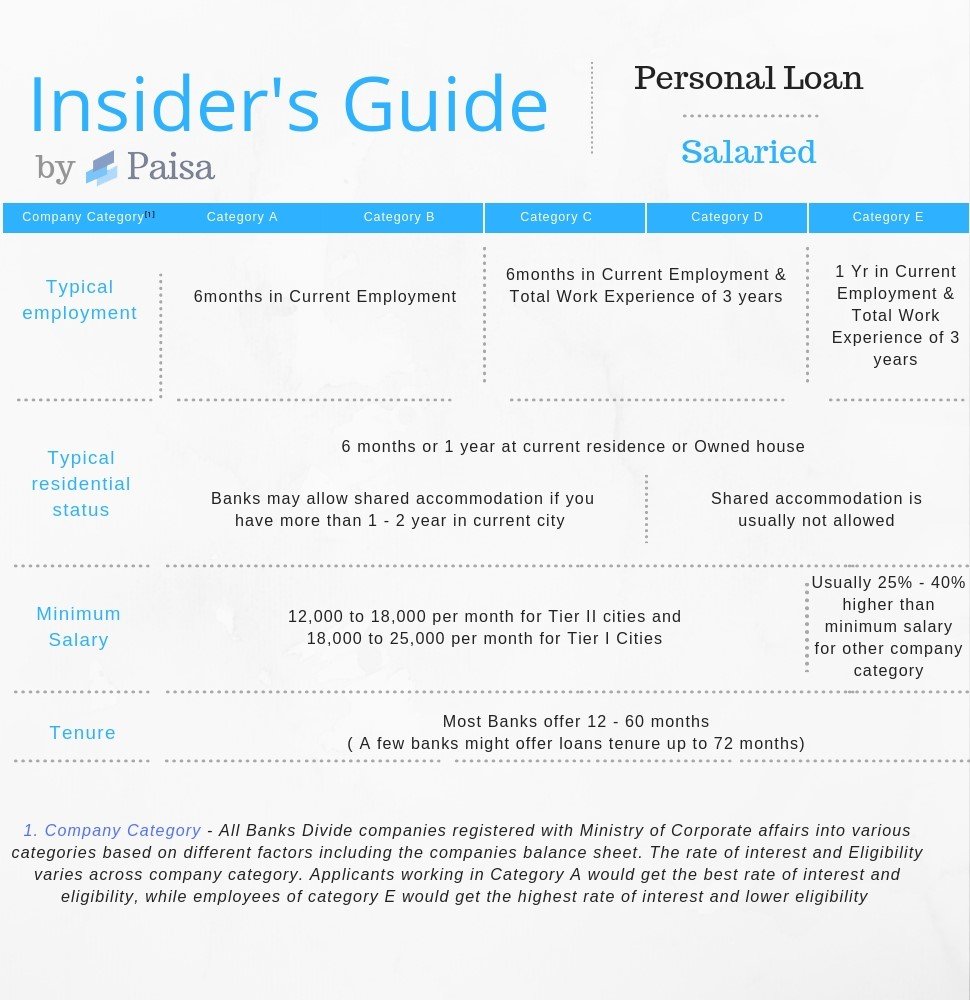

Your salary will also depend on the company in which you are working. The banks divide the companies into different categories such as Super A, Cat A, Cat B, Cat C, Cat D, and Cat E.If you are working for a company that comes under Super A or Cat A categories such as TCS, Wipro, or Infosys, then you will have bright chances of getting a loan.

Besides, you will also get a privilege of longer-term and a lower rate of interest. These companies are hot deals for banks. Cat A or Super A also includes some big pharmaceutical companies such as Sun Pharma, Ranbaxy, or Cipla. So, for applying for a personal loan you will need to check in which your category comes and what is the salary limit for that. A person must be working for at least 2 years in the current company.

You May Like to Read: Personal loan without salary slip

Place of Residence

Your place of residence also plays an important role in making you eligible for a personal loan. If you are residing in a place for more than 1 year and it’s your own residence, then you have bright chances. But if you reside in a place for less than 6 months and you are staying as paying guest or in rented accommodation, then you will have fewer chances of the loan as you might be a threat in case of non-payment of the loan.

Personal Loan Offer Depends on Credit Score

Forgetting the best offer for your personal loan you must have a good credit score. Any score which is more than 750 is considered a good credit score. The credit score can be checked by getting the credit report from the credit agencies such as CIBIL. You can get your credit report for free once a year.

You May Like to Read: 10 Things You Never Knew Ruined Credit Score

Documents:

The first document that you will need is an application form for applying for a personal loan. The other documents will include your identity proof, residential proof, age proof, income proof such as salary slips, bank statements, form 16, and any other as per the requirement of the bank or the institution where you have applied for a loan.

Application Fees:

This will be as per the bank’s rules. There are many other charges along with application fees such as part payment fees, pre-closure fees, late payment fees, and many more. These charges may vary from bank to bank.

So, check the above-mentioned points and make yourself eligible for getting a personal loan.